The oil gathering system and an associated central delivery and blending station will be located in Gonzales and Lavaca Counties, Texas and are expected to be constructed and operational by mid-2015.

Penn Virginia Corporation announce that it has sold the right to construct and operate a crude oil gathering and intermediate transportation system covering a portion of its Eagle Ford Shale acreage to Republic Midstream, LLC (Republic) for $150 million. Republic is a joint venture funded by ArcLight Capital Partners, LLC (ArcLight) that is managed by American Midstream Partners, LP and JP Energy Partners, LP. AMID and JPE are both affiliates of ArcLight. Part of the net proceeds from the sale will be used to repay the outstanding balance on our revolving credit facility, and the remainder will be used to help fund our Eagle Ford capital program.

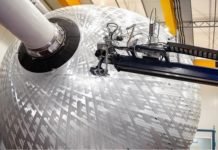

The oil gathering system and an associated central delivery and blending station will be located in Gonzales and Lavaca Counties, Texas and are expected to be constructed and operational by mid-2015. Penn Virginia will have a minimum committed volume of 15,000 barrels of oil per day for 10 years from the dedicated portion of its acreage. We believe the ability to gather crude oil volumes to a central delivery point, as well as to blend varying qualities of crude oil together, will ultimately benefit our price realizations, offsetting the costs of gathering. Moreover, we will substantially reduce any future capital expenditures related to oil gathering assets. We will retain our flexibility to market oil volumes both within and outside the dedicated area.

Acquest Advisors LLC served as PVA’s financial advisor in connection with the transaction.

H. Baird Whitehead, President and Chief Executive Officer, stated, “We are very pleased with the results of this sale, which is another step forward in our efforts to improve our liquidity and fund additional investment and further growth in the Eagle Ford. This transaction, along with the pending sale of our Mississippi assets and the gas gathering sale to AMID in January, brings the total proceeds from 2014 asset sales to $319 million, exceeding our original goal of up to $300 million.”