Europe’s largest generator of renewable power will no longer invest in new offshore wind projects and may postpone some international hydro plants.

Norwegian state-owned power company Statkraft will stop investing in offshore wind farms in order to keep paying dividends to its shareholders, even as it is reeling from power prices at a 15-year low. The company made the announcement on December 16 as it released a reduced investment plan. The decision follows Norway’s refusal to allow Statkraft to reinvest $574 million in new projects rather than pay it out as dividends.

The move means that the company will not invest in the 1.2-GW Dogger Bank and 900-MW Triton Knoll projects proposed in UK waters. Statkraft may also postpone two hydropower projects in Chile.

“Offshore wind power is capital intensive. The reduced financial terms from the owner entail that it is not possible for Statkraft to invest in new offshore wind projects,” said Statkraft Chief Executive Christian Rynning-Toennesen.

Last June, Statkraft also scrapped two wind power projects in Central Norway—with a combined capacity of 1 GW—because it said lower prices had rendered them unprofitable.

The announcement is a setback for Europe’s burgeoning offshore wind sector, where there were 3,072 grid-connected turbines at 82 farms spanning 11 countries, for a total of 10.4 GW of capacity as of June 30, 2015. China, the leader in offshore wind in Asia, had 718.9 MW of installed capacity; Japan, 52 MW; and South Korea, 5 MW by October 2015.

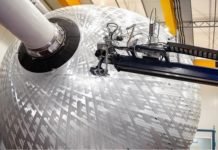

Overall, the sector will see a downturn in 2016, predicted consulting firm Douglas-Westwood. “Following a strong year of offshore wind activity in 2015 (3.8 GW installed), capacity installed will dip in 2016 to 1.5 GW. However, capacity will return to an upward trend, peaking at 9.2 GW in 2022,” it said in a recent insight. The firm also noted that capital costs for offshore wind have fallen in recent years, owing to the larger sizes of turbines installed and resulting in less infrastructure (such as support structures) required.