The traditional narrative around carbon capture has focused largely on carbon capture and storage (CCS) capturing emissions at their source and locking them permanently in geological formations. While storage remains essential for deep decarbonisation, a parallel opportunity is gaining momentum: carbon utilisation. Rather than burying captured CO2, power producers and industrial operators can transform it into commercially valuable products. This shift fundamentally changes the economics of carbon capture, converting what might otherwise be a cost centre into a revenue-generating asset.

Carbon utilisation pathways for power producers are diverse, spanning synthetic fuels for aviation and shipping, building materials for construction, chemical feedstocks for industrial synthesis, and polymers and plastics for consumer goods. Each pathway offers distinct market sizes, technical requirements and economic profiles. For power companies considering investments in carbon capture infrastructure, understanding these utilisation options is critical to project viability and long-term returns.

The case for carbon utilisation in decarbonisation strategy

Carbon utilisation represents one of several decarbonisation levers available to power producers and energy-intensive industries. Efficiency improvements, fuel switching, renewable energy deployment and direct carbon storage all play roles in reducing emissions. However, carbon utilisation pathways for power producers offer a unique advantage: they create positive economic value while addressing emissions.

When captured CO2 is permanently stored underground, the value proposition rests primarily on carbon pricing, tax credits or regulatory compliance incentives. These mechanisms, while important, can fluctuate with policy changes. In contrast, when captured carbon is converted into products with genuine market demand such as synthetic aviation fuel or cement additives the business case becomes more resilient. The captured CO2 becomes a commodity feedstock worth money in its own right.

This distinction matters enormously for project developers. Power plants equipped with carbon capture facilities can potentially earn revenue from multiple sources: electricity sales, carbon credits under emissions trading systems, carbon tax credits such as the 45Q programme in the United States, and direct sales of captured CO2 or carbon-derived products. This revenue stacking improves returns on investment, making carbon utilisation pathways for power producers increasingly attractive compared to capture-and-storage-only approaches.

Moreover, carbon utilisation supports broader decarbonisation by enabling other sectors to reduce emissions without rapid asset retirement. Rather than requiring steelmakers, cement producers or aviation operators to immediately abandon existing infrastructure, carbon utilisation allows them to shift gradually toward lower-carbon practices by integrating captured CO2 as a substitute for virgin fossil feedstocks. This smoother transition can garner political support and reduce total system costs.

Synthetic fuels: a major utilisation pathway

Among carbon utilisation pathways for power producers, synthetic fuel production often called e-fuels or carbon-neutral fuels represents one of the largest and most commercially advanced opportunities. Synthetic fuels are hydrocarbons created by combining captured CO2 with hydrogen, typically green hydrogen produced via renewable electricity. The resulting fuels can substitute directly for conventional petroleum products in existing infrastructure, requiring minimal equipment modification.

The most developed synthetic fuel pathways include e-kerosene (synthetic jet fuel), e-methanol, and e-naphtha. E-kerosene is particularly valuable because aviation has limited options for decarbonisation. Commercial aircraft cannot easily switch to battery power, and sustainable aviation fuel (SAF) made from biomass faces feedstock constraints. Synthetic e-kerosene produced from captured CO2 and green hydrogen offers a true drop-in replacement with potentially unlimited scalability, provided captured carbon and renewable electricity are available.

E-methanol, another promising product, can serve as a fuel for shipping, power generation and industrial processes. It is easier to produce synthetically than some alternatives and can be transported using existing infrastructure. However, the economics depend critically on carbon pricing and hydrogen costs. Research indicates that e-methanol requires carbon prices in the range of $200–$450 per tonne of CO2 to achieve profitability, suggesting that current market conditions alone may not yet support large-scale deployment without policy support.

For power producers, synthetic fuel projects typically operate as follows: captured CO2 from power plants or nearby industrial sources is compressed and transported to a synthesis facility. There, it is combined with green hydrogen produced via renewable electricity in electrolysers. Catalytic reactors then convert the CO2 and hydrogen mixture into liquid hydrocarbons. The resulting fuels are purified, distributed, and sold into existing markets for aviation, shipping or industrial heat.

Several pilot and demonstration projects are advancing synthetic fuel production. In Spain, a project incorporating accelerated carbonation technology aims to capture CO2 from a refinery and convert it into aggregates for construction. In Iceland, a facility is developing advanced process technology for e-kerosene production. In Europe, an ambitious initiative plans to convert 300,000 tonnes of CO2 per year into 100,000 tonnes of e-fuels and clean-burning naphtha using captured emissions from steel production combined with green hydrogen. These projects are proving that carbon utilisation pathways for power producers can scale beyond laboratory prototypes.

Industrial feedstocks and building materials

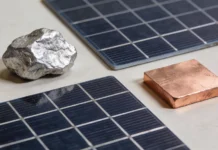

Beyond fuels, carbon utilisation pathways for power producers extend into industrial feedstocks and construction materials. Captured CO2 can be used as a raw material in cement production, aggregate manufacturing, polymer synthesis and chemical production. These applications often require smaller quantities of CO2 compared to fuel synthesis but can command premium prices for specialised products.

In cement manufacturing, for example, CO2 can be carbonated into aggregates or used directly in novel binding systems. This addresses two challenges simultaneously: cement production, which generates significant CO2 emissions, can reduce its carbon footprint by recycling captured carbon while improving material properties. Similarly, in plastics and polymer production, captured CO2 can partially replace petroleum-derived feedstocks, reducing dependence on fossil fuels.

Building materials incorporating captured carbon have emerged as a growing market segment. Accelerated carbonation technology can convert CO2 into solid mineral forms suitable for concrete, insulation or decorative applications. These products capture CO2 permanently it remains locked in the material for decades or longer, providing effective long-term storage while delivering utility value.

The economics of building materials differ from synthetic fuels. Whereas e-kerosene or e-methanol must compete on a price-per-litre basis with petroleum products, building materials can often command premium pricing based on their low-carbon or carbon-negative attributes. Sustainable construction has become a requirement in many developed markets, and builders and developers are willing to pay for certified low-carbon materials. This makes carbon utilisation pathways for power producers particularly viable in the construction sector.

Power producers can participate in these value chains in several ways. Some may integrate backward into CO2 utilisation, establishing joint ventures or subsidiaries that transform captured emissions on or near power plant sites. Others may sell captured CO2 to specialised utilisation companies that focus on specific conversion pathways. Still others may participate in industrial clusters or hubs where multiple emitters supply CO2 to centralised utilisation facilities, sharing infrastructure costs.

Power-to-X applications and sector coupling

Carbon utilisation pathways for power producers extend beyond traditional chemical synthesis into broader power-to-X applications, where excess renewable electricity is converted into various energy carriers and chemical products. In a power-to-X framework, captured CO2 serves as one input in a suite of possible conversions: power-to-hydrogen, power-to-methane, power-to-chemicals, and power-to-fuels.

The advantage of power-to-X approaches lies in flexibility and sector coupling. A power producer with access to low-cost renewable electricity, captured CO2 and electrolyser capacity can adjust production among multiple pathways depending on market conditions. If hydrogen prices spike, the facility can produce and sell hydrogen directly. If fuel demand strengthens, the same facility can shift toward synthetic fuel production. This operational flexibility mitigates revenue risk compared to single-product facilities.

Sector coupling also enables power producers to support decarbonisation across other industries. A power plant with carbon utilisation capabilities can supply green hydrogen to steelmakers, captured CO2 to cement producers, and synthetic fuels to refineries and aviation operators. By positioning itself at the nexus of multiple value chains, the power company becomes more integral to its industrial ecosystem and less vulnerable to shifts in any single market.

However, realising power-to-X applications at scale requires several enabling conditions. Renewable electricity must be abundant and affordable ideally cost $20–$40 per megawatt-hour or less. Green hydrogen produced via electrolysis must reach cost targets around $1.50–$2.50 per kilogramme. And captured CO2 feedstock must be available and reliably sourced, whether from point-source industrial emissions or direct air capture. In regions meeting these conditions, carbon utilisation pathways for power producers can flourish.

Technical hurdles and cost reduction pathways

Despite the promise of carbon utilisation pathways for power producers, significant technical and economic challenges remain. Synthesis processes typically require expensive catalysts, often containing rare or precious metals. Energy consumption in conversion processes is high, and if electricity is not low-carbon, the lifecycle emissions benefit shrinks. Feedstock costs particularly for captured CO2 and green hydrogen dominate overall production costs.

Research and development efforts are focused on reducing these barriers. Advanced catalytic materials, including non-precious-metal alternatives, are being developed to lower costs and improve conversion efficiency. Electrolyser technology is advancing rapidly, with cost reductions expected to continue as deployment scales. Direct air capture (DAC) technology, which extracts CO2 directly from ambient air rather than from point sources, is improving, though it remains more expensive than point-source capture.

Indirect policy mechanisms play a crucial role in bridging the cost gap. Carbon pricing through emissions trading systems or carbon taxes makes CO2 utilisation more economically attractive by raising the cost of unabated emissions. Subsidies or tax credits for low-carbon products can support nascent technologies until production scales and costs fall. Research funding and public-private partnerships can accelerate technology maturation and demonstrate commercial viability.

For power producers, understanding these cost reduction pathways is essential to long-term planning. Projects built today may not be economically viable without policy support, but as technology improves and costs fall, comparable projects in the future may be profitable without subsidies. Early movers willing to tolerate policy dependency or accepting lower returns may position themselves as technology leaders and benefit from learning advantages and future cost reductions.

Project economics and revenue stacking

Carbon utilisation pathways for power producers fundamentally improve project economics through revenue diversification. A power plant equipped with carbon capture and utilisation capabilities can earn revenue from multiple sources simultaneously: electricity sales, ancillary grid services, carbon credits or allowances under emissions trading schemes, carbon tax credits under mechanisms like the 45Q programme, and direct sales of captured CO2 or carbon-derived products.

This revenue stacking significantly improves the internal rate of return and payback period compared to capture-and-storage-only projects. For example, a facility producing synthetic fuels might generate revenue from three sources: the sale of e-fuel into aviation or shipping markets, carbon tax credits earned by avoiding emissions, and potentially premium payments from buyers seeking certified sustainable fuels. With multiple revenue streams, the project can tolerate lower margins on any single product and still achieve acceptable returns.

The financial case becomes even stronger when carbon utilisation is integrated with renewable energy and hydrogen production. A power producer operating solar or wind assets, electrolysers for green hydrogen production, and CO2 utilisation facilities creates a vertically integrated low-carbon energy complex. Such a configuration can optimise electricity flows internally, avoiding external grid charges and transmission losses, and capturing value at multiple points along the value chain.

However, project financing remains challenging. Utilisation pathways face technical risk newer technologies may underperform projections. Market risk is also significant; demand for synthetic fuels or building materials may not develop as expected. Regulatory risk is notable; changes in carbon policy, trade rules or fuel standards can affect viability. These risks can raise capital costs and deter investment, particularly for first-of-a-kind projects. Policies that reduce uncertainty such as long-term commitments to carbon pricing, guaranteed offtake agreements for low-carbon products, or technical performance guarantees can facilitate project development.

Emerging business models and partnerships

As carbon utilisation pathways for power producers mature, new business models are emerging. Some power companies are establishing dedicated carbon utilisation subsidiaries that focus on converting captured CO2 into specialised products. Others are forming joint ventures with chemical companies, fuel producers or construction material manufacturers to share technical expertise and capital requirements.

Industrial cluster approaches represent another promising model. Rather than developing isolated facilities, power producers are collaborating with steelmakers, refineries, cement producers and other industrial emitters to create integrated hub-and-spoke systems. Captured CO2 from multiple sources feeds into centralised utilisation facilities, improving asset utilisation and reducing per-unit costs. Such clusters also benefit from shared infrastructure for transport, storage and distribution of products.

Partnerships with technology providers are critical. Specialised firms developing advanced catalysts, separation technologies, or conversion processes often lack capital to scale production independently. Alliances with established energy companies can accelerate deployment while allowing technology developers to focus on innovation. As carbon utilisation pathways for power producers expand, we can expect increasingly sophisticated partnerships spanning energy, chemicals, materials and technology sectors.

Regulatory and policy enablers

Carbon utilisation pathways for power producers require supportive policy frameworks to thrive. Current carbon prices in most emissions trading systems typically $30–$100 per tonne of CO2 are often insufficient to make utilisation economically viable without additional support. However, explicit carbon pricing combined with other mechanisms can shift the economics.

Carbon tax credits, such as the U.S. 45Q programme, can provide direct financial incentives for utilisation projects. Mandates for sustainable fuels in aviation, shipping or other sectors can create guaranteed demand and justify investment in synthetic fuel capacity. Building standards that favour low-carbon materials can support demand for CO2-derived construction products. Contracts for difference or similar mechanisms can provide revenue certainty for emerging utilisation pathways.

Standardisation and certification are also important. As diverse carbon utilisation pathways for power producers develop, consistency in measuring lifecycle emissions, certifying products and preventing double-counting of emission reductions is essential. International standards and verification frameworks will support market confidence and enable cross-border trade in carbon-derived products.

The role of carbon utilisation in power system decarbonisation

Ultimately, carbon utilisation must be understood within the broader context of power system decarbonisation. For existing coal and gas plants transitioning to lower-carbon operations, carbon capture with utilisation offers a bridge strategy. Rather than requiring immediate retirement, plants can be retrofitted with capture technology and equipped to participate in carbon utilisation value chains. This preserves assets and employment while reducing emissions substantially.

In regions where fossil generation will continue for some years due to grid reliability requirements or economic constraints, carbon utilisation pathways for power producers allow that generation to operate as lower-carbon alternatives to unabated fossil fuels. While eventually, direct renewable energy and batteries will dominate, carbon utilisation can support a smoother, more politically feasible transition path.

Conclusion:

Looking forward, carbon utilisation will likely be most significant in sectors difficult to decarbonise directly. Aviation, shipping, steelmaking and cement production all rely on energy-dense fuels or high-temperature heat that are challenging to provide via electrification alone. Synthetic fuels derived from captured CO2 and green hydrogen offer a practical pathway for these sectors. Power producers positioned at the centre of these value chains producing renewable electricity, capturing carbon and synthesising fuels will occupy a crucial role in a deeply decarbonised energy system.