The accelerated rise of solar marks a definitive shift in the global energy mix. It’s not simply about technological innovation, although advances in module efficiency, digital controls, and large-scale storage have been critical. The story is also one of pragmatic adaptation, as businesses and governments seek cost-effective means to decarbonize, diversify, and secure grids against emerging shocks.

In practical terms, the prospect of solar increasingly exceeds initial expectations. As of late 2024, cumulative global solar capacity surpassed 2.2 terawatts (TW), up from 1.6 TW in 2023, with a stunning 597 GW installed in a single year. This momentum is formidable and projected to continue: if current trends persist, annual installations could reach 1 TW by 2030, making solar the fastest-growing electricity source in history.

The map of global solar potential and opportunity is far from uniform. Geographic, regulatory, and market conditions drive profound disparities, not merely in installed capacity, but also in latent resource potential and accessibility for industry operators.

Global Solar Potential: Regional Resource and Promise

Solar resource potential reflects a blend of natural abundance and practical accessibility. Irradiance, climate, and landscape set the foundation, but deployment depends equally on policy clarity, infrastructure, and investment availability.

Globally, solar irradiance is distributed with surprising equity. According to World Bank and IEA analyses, more than 90% of the world’s population lives in countries where average daily solar PV output ranges from 3 to 5 kWh per installed kWp. That means most industrial regions are well-positioned to harness solar competitively, provided that grid and market conditions allow immediate integration.

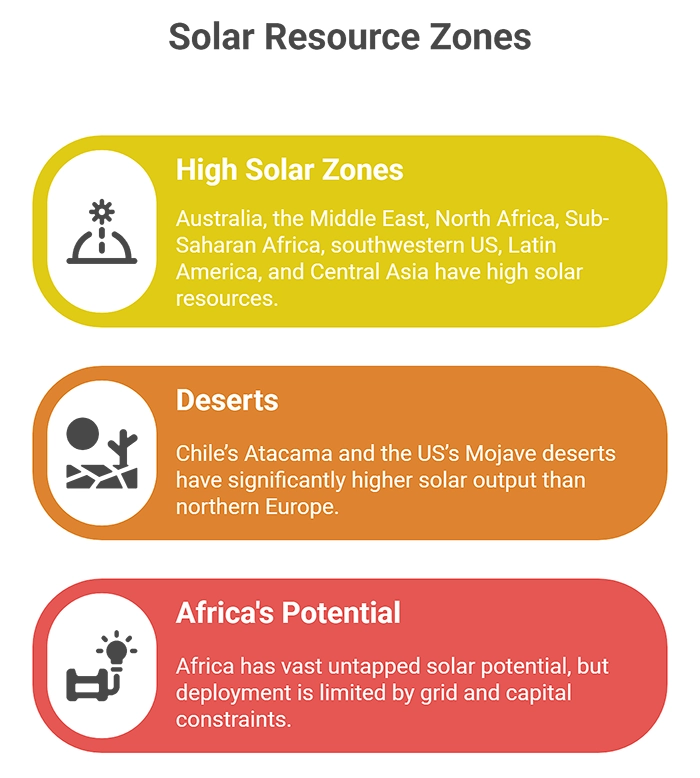

- High solar resource zones include Australia, the Middle East, North Africa, Sub-Saharan Africa, the southwestern US, and major swathes of Latin America and Central Asia.

- Chile’s Atacama and the US’s Mojave deserts are exemplary; for comparison, their annual solar output exceeds that of northern Europe by a factor of 1.8–2, even though European grids are more mature.

- Africa’s vast solar potential remains largely untapped. Less than 0.01% of Ethiopia’s land, for instance, could satisfy its entire electricity demand with solar alone, but deployment is held back by grid and capital limits.

This technical opportunity is matched by increasing economic viability. As module prices have declined including a 57% spike in global panel manufacturing from 2021 to 2022, capital costs have plummeted. Lower barriers bring solar within reach in regions where it was once considered out of budget.

Growth Trends

Solar growth is not only rapid, but also uneven and marked by regional pivots, competitive recalibrations, and policy interventions.

China remains the undisputed leader, commissioning 357 GW in 2024, nearly 60% of global new additions and now holding over 1 TW of cumulative capacity. State-driven investment, dominant manufacturing scale, and long-term strategic planning have built what is solidly the world’s largest solar market. China’s approach is benefiting not only domestic energy security but also lowering costs for downstream markets worldwide.

India has made dramatic progress as well, with 116 GW installed by mid-2025 and aggressive targets to reach 280 GW by 2030. The country is leveraging its high solar potential (up to 748 GW in total) through policies that encourage both utility-scale development and decentralized rural electrification. Incentive programs like PM Surya Ghar Yojana and PM Kusum Yojana support residential and agricultural solar, eating away at fossil fuel dependence and driving job creation.

Other fast-growing markets include the United States and Germany, both showing strong year-on-year capacity increases. The US surpassed 200 GW, with solar forming 11% of its total electricity mix. Federal tax credits and favorable corporate procurement frameworks drive installations, although grid limits constrain future expansion. Germany added 16.7 GW in 2024, with robust legislative support at EU and local levels.

- Brazil, Australia, Spain, and Italy are key secondary leaders, together contributing over 250 GW in aggregate installed capacity.

- Japan and South Korea continue scaling rooftop and distributed solar in dense urban markets.

- Emerging players like Turkey, Vietnam, the UAE, and South Africa are showing double-digit growth rates, capitalizing on improved financing and tariff structures.

Solar’s economic impact is substantial. The industry’s global value reached approximately $278 billion in 2024 and is forecast to grow at a 4.3% compound annual rate, reaching $334 billion by 2029. This expansion is mirrored in manufacturing, with 1.5 billion panels produced worldwide in 2022 alone, a 57% leap from 2021.

At the same time, market concentration remains high. Over half of all module shipments and installations are concentrated in the top five countries, reflecting ongoing supply chain vulnerabilities and the importance of diversified sourcing strategies for B2B operators.

Systemic Challenges and Evolution in Solar Project Dynamics

For professionals in the field, solar energy deployment is not without its core challenges. Grid integration, absorption of intermittent renewables into stable networks remains a recurring concern, especially as solar’s market share grows. Regions with outdated grid infrastructure can encounter bottlenecks, curtailments, and price volatility, most notably during periods of excess generation. For example, surplus solar power has periodically driven wholesale prices negative in Australia and California, while rapid renewable adoption triggered frequency blackouts in southern Europe earlier this year.

Financing and permitting obstacles can also delay projects, particularly in emerging markets where security of investment isn’t assured. A typical project lifecycle encompasses site selection, irradiation assessment, environmental reviews, stakeholder engagement, engineering, permitting, and commissioning—a sequence that often involves months, sometimes years, of regulatory navigation. Cooperation between developers, local authorities, utilities, and the finance sector is a prerequisite for timely progress.

Outlook from a senior editorial standpoint: Addressing these systemic issues means embracing innovation at multiple levels—grid modernization, demand-side management, and market reform. The rise of battery storage, flexible contracts, and smart digital controls make solar increasingly dispatchable and resilient. Investment in storage, both at utility and distributed scale, is expected to grow dramatically, supporting stable supply and further raising solar’s share in total generation.

Regional Snapshots: Differentiation and Opportunity

Asia-Pacific

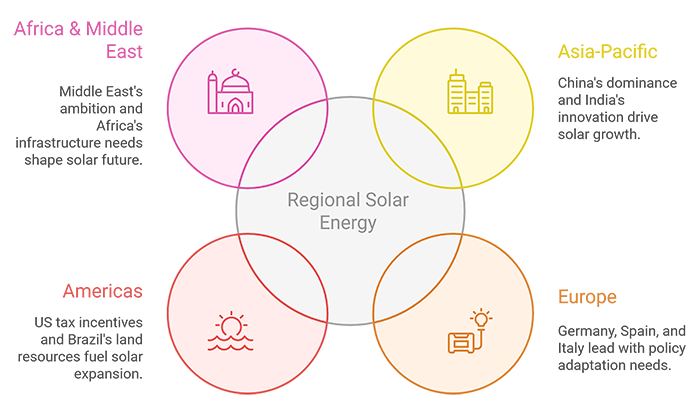

- China’s dominance is expected to persist, setting trends in manufacturing, deployment, and policy alignment.

- India’s push toward 500 GW of non-fossil capacity by 2030 situates it as an innovator, especially in rural electrification and hybrid renewables.

- Southeast Asia is accelerating distributed solar, with Vietnam and Indonesia embracing local grid solutions.

Europe

- Germany, Spain, and Italy are consolidating leadership, but rising grid congestion and land use conflicts highlight the need for policy adaptation.

- The EU-wide “Fit for 55” package is expected to further stimulate regional harmonization of incentives.

Americas

- The US solar sector remains vibrant, spurred by tax incentives and a dynamic corporate market.

- Brazil’s vast land resources support rapid utility-scale rollout, though financing remains variable.

Africa & Middle East

- The Middle East is positioning itself as a future global hub, leveraging strong irradiance and ambitious government targets, especially in Saudi Arabia and the UAE.

- Africa’s progress depends on infrastructure build-out and international financing, with Nigeria, Egypt, and South Africa as focal growth markets.

Conclusion

Solar’s rise is both a story of universal possibility and practical differentiation. While resource potential is high across vast swathes of the planet, the deployment landscape is determined by a matrix of policies, grid readiness, capital flows, and supply chain maturity.

For industry leaders, strategic market entry should be informed by thorough resource mapping, regulatory intelligence, supply chain risk assessments, and close observation of localised policy shifts. As solar installations approach 1 TW annually and market value grows past $300 billion, the competitive field will be shaped by agility, partnership innovation, and proactive risk management.

At the same time, the sector faces persistent challenges. Grid bottlenecks, policy discontinuities, and capital barriers require adaptive solutions and informed advocacy. The convergence of solar with battery storage, digital grid management, and hybrid generation models points to a future where energy systems are not only sustainable but far more resilient and flexible than their predecessors.

For professionals across the supply chain, the coming decade represents a window of opportunity, one where aligning operational priorities with global trends, while negotiating the granular realities of local markets, will define success. In practical terms, solar’s expansion is more than a resource story—it’s the new backbone of the energy transition, setting a dynamic course for industry transformation through 2030 and beyond.