Key Takeaways:

- Risk management strategies emerging low carbon power investments systematically address technology risks through staged development and vendor guarantees, market uncertainties via offtake contracts and hedging, regulatory exposure through policy scenario analysis and flexible design, ensuring investment-grade returns across hydrogen electrolysis, carbon capture retrofits and renewable hybrid configurations.

- Revenue stabilisation combines multiple income streams energy sales, capacity payments, carbon credits, ancillary services and product offtake while insurance products, public-private partnerships and financial engineering transfer residual risks, enabling first-mover advantage in emerging clean technologies despite prevailing uncertainties.

Emerging low-carbon power investments hydrogen electrolysis hubs, carbon capture retrofits, renewable hybrids promise decarbonisation at scale but carry unprecedented risks spanning nascent technologies, volatile markets, policy uncertainty and operational complexity. Effective risk management strategies emerging low carbon power investments distinguish viable projects from stranded assets, enabling institutional capital deployment at required scale.

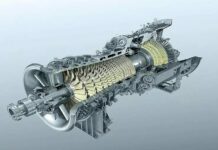

Traditional power project risks (construction delays, fuel price volatility) compound with clean technology uncertainties. Electrolyser lifetimes remain unproven at GW scale. Carbon capture energy penalties erode plant economics. Hydrogen markets lack liquidity. Risk management strategies emerging low carbon power investments apply structured frameworks to identify, quantify, allocate and mitigate across lifecycle phases.

Technology risk identification and mitigation

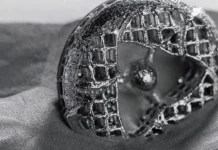

Technology risk dominates first-of-a-kind deployments. PEM electrolysers promise rapid response but face membrane degradation, catalyst poisoning and stack replacement uncertainty. Carbon capture solvents degrade under real flue gas conditions. Risk management strategies emerging low carbon power investments employ technology readiness gates: laboratory validation, pilot operation, pre-commercial demonstration before full financing.

Vendor guarantees transfer performance risk. Multi-year warranties cover efficiency guarantees, hydrogen purity and maintenance intervals. Penalty clauses enforce uptime targets. Independent engineering reviews validate manufacturer claims against third-party testing. Staged capital commitment aligns payments with milestones—factory acceptance testing, commissioning, performance acceptance.

Modularisation mitigates scale risk. Containerised electrolyser skids enable parallel deployment and learning. Digital twins validate performance pre-construction. Supply chain diversification prevents single-vendor dependency. Technology escrow ensures intellectual property continuity.

Market and revenue uncertainty management

Hydrogen lacks mature pricing signals. Green premiums exist but fluctuate with policy. Electricity wholesale exposure compounds arbitrage strategies. Risk management strategies emerging low carbon power investments secure long-term offtake through corporate PPAs (5-15 years) with industry consumers valuing decarbonisation attributes. Index-linked pricing ties revenue to carbon benchmarks.

Revenue stacking diversifies exposure. Capacity markets remunerate firm power availability. Ancillary service auctions monetise electrolyser response. Renewable integration credits reward curtailment avoidance. Carbon credits (45Q, EU ETS) provide backstop. Financial hedges swaps, options manage price volatility.

Demand risk mitigation includes geographic diversification and multi-product capability. Flexible plants switch hydrogen/power production modes. Export pipelines access premium markets. Insurance covers offtake shortfalls.

Regulatory and policy risk frameworks

Policy dependency creates binary outcomes. Subsidy termination strands projects mid-development. Blending mandates drive demand but face delays. Risk management strategies emerging low carbon power investments conduct scenario analysis across policy baselines: aggressive (high carbon price), moderate (gradual phase-in), adverse (subsidy cliffs).

Flexible design accommodates uncertainty. Capture-ready plants enable retrofits. Hydrogen-blending turbines future-proof assets. Multi-fuel electrolyser sites hedge green/blue hydrogen shifts. Regulatory sandboxes test novel business models.

Political risk insurance (PRI) covers expropriation or discriminatory regulation. Public-private partnerships share sovereign risk. Revenue support mechanisms CfDs, strike prices bridge gaps to merchant viability.

Operational and counterparty risks

Operational complexity multiplies failure modes. Hydrogen safety protocols demand rigorous training. Carbon capture integration stresses existing plants. Risk management strategies emerging low carbon power investments implement comprehensive O&M frameworks: digital twins for anomaly detection, predictive maintenance reducing downtime 25%, remote monitoring centres for rapid response.

Counterparty risk affects financing and offtake. Investment-grade counterparties for PPAs. Parent guarantees for project companies. Credit enhancements via reserves or letters of credit. Diversified lender syndicates prevent single-bank exposure.

Construction risks follow proven EPC strategies: fixed-price turnkey contracts, liquidated damages, performance bonds. Modular prefabrication reduces site risk.

Financial structuring and de-risking instruments

Optimal capital structure balances equity returns with debt security. Non-recourse project finance requires robust cashflow coverage (1.3-1.5x). Mezzanine debt fills gaps. Tax equity leverages clean energy incentives.

De-risking instruments unlock institutional capital. Credit enhancements guarantee debt service. Political risk insurance covers sovereign exposure. First-loss equity absorbs early volatility. YieldCo structures monetise operating assets post-construction.

ESG frameworks attract impact investors. Green bonds fund certified projects. Sustainability-linked loans reward performance.

Case studies and lessons learned

European hydrogen valleys demonstrate integrated risk management. North Sea hubs combine offtake guarantees, government equity and modular scaling. U.S. 45Q-funded projects leverage tax equity with technology guarantees. Australian solar-to-hydrogen exports secure LNG offtake conversions.

Common success factors: staged development, revenue diversification, strong sponsors, policy alignment. Failures trace to over-reliance on single revenue streams, unproven technologies at scale, policy timing mismatches.

Strategic investment implications

Risk management strategies emerging low carbon power investments enable disciplined capital allocation. Portfolio approach across technologies/geographies diversifies exposure. Early positioning secures prime sites infrastructure, geology, renewables. Policy advocacy shapes supportive frameworks.

As costs decline and markets mature, risk premia compress. First-movers accepting structured risk today capture compounding advantages tomorrow. Sophisticated risk frameworks thus transform emerging low-carbon power investments from speculative ventures into infrastructure-grade opportunities essential to net-zero trajectories.