The Micro, Small, and Medium Enterprises (MSME) sector is expected to contribute significantly to achieving the government’s target of building 40 gigawatt (GW) of the rooftop solar capacity by 2022. Scaling up rooftop solar in the MSME sector in India requires addressing issues related to lack of low-cost financing, inadequate level of awareness, and lack of rooftop aggregation models, according to a new report from Deloitte and Climate Investment Funds (CIF).

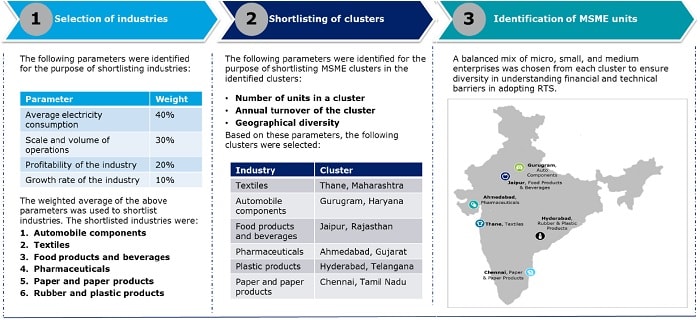

The report Scaling up rooftop solar in the SME sector in India evaluates key issues based on the primary survey done across 150 MSMEs in six industrial clusters (rubber and plastic; pharmaceuticals; auto; paper; food and beverage; and textiles) in India, selected on the basis of a pre-determined criteria. The report recommends possible solutions for triggering rooftop solar growth in the MSME sector in India.

“A well-conceived walk-through survey of 150 MSMEs depicted the willingness towards adoption of rooftop solar applications but strengthening an enabling ecosystem will be critical for its proliferation,” says Tushar Sud, Partner, Deloitte Touche Tohmatsu India LLP.

“Limited access to finance, need to strengthen awareness, and escalating energy expenses are impacting the long-term profitability, competitiveness, and sustainability of the sector. However, it presents great opportunity, and a multi-pronged approach involving supportive regulations, risk-bearing financing, and awareness building is needed to demonstrate viability and help scale up rooftop solar in the sector,” says Abhishek Bhaskar, Energy Specialist, CIF.

The study adopted the below mentioned approach. The report highlights possible solutions to address the key barriers affecting rooftop solar growth in the MSME sector. Some of them are as follows:

The report highlights possible solutions to address the key barriers affecting rooftop solar growth in the MSME sector. Some of them are as follows:

- In the initial stages, target industry clusters where the likelihood of achieving intended outcomes is higher and developing customised market plans is imperative.

- The Indian rooftop solar market is currently not geared to implement large-scale rooftop solar projects under the OPEX model in the MSME sector without institutional or financial interventions. A dedicated aggregation vehicle could support the implementation of rooftop solar projects across the target MSME clusters.

- Regulatory changes for the adoption of group and virtual net metering could assist in implementing aggregation models in the MSME clusters and overcoming issues related to scale, diverse customer profile, and financing.

- Supporting dedicated MSME-based portfolios within existing or new lines of concessional credit is expected to support the development of rooftop solar projects in the MSME sector.

- Dedicated scheme supported by the Ministry of MSME with financial interventions, such as interest subvention and the Partial Risk Guarantee Fund mechanism, through budgetary allocations may be required for pilot projects across target clusters.

- Creating awareness and capacity building through dedicated initiatives to bridge knowledge gaps and support the adoption of rooftop solar in the MSME sector.

“World Bank has long supported India’s renewable energy ambitions, including rooftop solar, which is an integral part of our clean energy strategy. Supported by the Clean Technology Fund (CTF), the program has delivered financing to close to 300 MW so far working in close partnership with State Bank of India (SBI), and is all poised to surpass its initial goals. This CTF supported work is quite timely since a significant amount of this financing goes to installations for MSMEs, a sector that we have also identified as one of the potential areas for future growth” says Simon Stolp, Lead Energy Specialist, The World Bank.

About Deloitte Touche Tohmatsu India LLP

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please see www.deloitte.com/about for a more detailed description of DTTL and its member firms.

Deloitte India herein refers to Deloitte Touche Tohmatsu India LLP.

About CIF

The Climate Investment Funds (CIF), as one of its objectives, is working towards accelerating climate action by empowering transformations in clean technology, energy access, climate resilience, and sustainable forests in 72 developing and middle-income countries. The $5.5 billion CTF has been working towards empowering transformation in developing countries by providing resources to scale up low carbon technologies with significant potential for long-term greenhouse gas emissions savings.