The flagship legislation, the Inflation Reduction Act, which is focused on speeding up decarbonization in the US, will push the annual renewables investment from $64 billion to almost $114 billion by 2031, as per a recent report. Boom Time: What the Inflation Reduction Act Means for US Renewable Manufacturers gives an initial understanding of how the legislation is going to help US renewable equipment manufacturing capacity expand by way of certain opportunities that will vary with each segment.

One of the authors of the report opined that there will be a complete reshaping of the renewable supply chain across the US by the IRA, which will incentivize the restart of facilities that are shut down as well as help provide options to develop a total equipment supply chain from the very beginning. It is assumed that 2 key provisions are likely to be the game changers for renewable equipment manufacturers. The first is going to be advanced manufacturing production credits, which provide tax credits for renewable equipment made in the US. The second provision will be to incentivize US renewable energy project developers to buy domestically manufactured equipment and give a surplus tax credit if they meet the threshold of the domestic content requirement.

To qualify for both, 40% of the total equipment utilised must be manufactured in the US and should be installed on the projects before 2025. 20% of these projects have to be offshore wind. The percentage will rise to 55% post-2026 as well as 2027 for offshore wind. This is going to be high stakes for sales of US equipment as the IRA shall provide incentives that shall cut the manufacturing cost of solar panels, wind towers, and storage equipment by anywhere between 4% and 30%. Along with this, some import tariffs will also put domestic manufacturing on a competitive footing based on cost as compared to equipment that is imported.

There is an expectation that the US onshore wind manufacturing sector will take full advantage of these credits, which will help OEMs reverse declining margins on equipment sales and also incentivize investment in manufacturing.

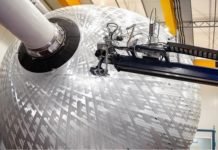

Because of the limited US manufacturing capacity as well as natural cost advantages over imports and the need to invest in domestic manufacturing, offshore wind manufacturers are expected to take into account the full value of the APMC.

The IRS—Internal Revenue Service—shall look into the eligibility requirements and guidance on how to get support on tax credits, which will happen to be an important factor for manufacturers’ investment decisions.