The Covid-19 viral pandemic, which sparked a global quarantine, has caused short and long term consequences across most industries, including the global energy market. A halt in daily commuting worldwide coupled with the rise of home office work and the virtual end to global travel has had serious implications on energy demand, with experts predicting that this year will see some of the biggest drops in demand since the Great Depression of the 1930s.

According to the International Energy Agency, global energy demand across 2020 will drop approximately 6%. This is an extraordinarily high number. To put the significance of this 6% in perspective, the 2008 financial crisis, which was the previous worst economic disaster to affect the global energy market, only saw an energy demand drop of less than 1%. The more advanced the national or regional economy, the more impactful Covid-19’s energy demand consequences will be, with the IEA anticipating a 9% and 11% demand drop in the US and European Union, respectively.

Uneven distribution of the global fall in energy demand

Energy demand decreases are not equally distributed by any means. For example, while electricity, gas, and coal are all on the decline in 2020, low carbon and renewable energy sources are experiencing an increase. For electricity, which will see a projected 5% drop worldwide, this drop is largely due to the countless office spaces that are going unused during the national lockdowns. By contrast, coal and gas demand drops are due to a combination of the pandemic and global trends toward renewable energy sources.

Without a doubt, the energy sources most severely affected by the pandemic, subsequent lockdowns, and energy trends have been coal and gas, with natural gas set to experience a 10% global decrease over 2020. For coal, this decrease will likely be close to 8% or more.

Home energy use during the pandemic

In the midst of decreased energy demand, home appliance energy use is actually increasing, with more consumers working from home and children conducting coursework from home rather than in classrooms. Furloughs and wage cuts during the Covid-19 pandemic have put a significant dent in the disposable incomes of household earners, putting on hold many plans to replace aging home appliances.

Therefore, now more than ever is a time to embrace the DIY approach when it comes to maintaining existing infrastructure, from the micro home consumer levels to the macro national infrastructure. Whether it is a single family forced to put their kitchen renovation plans on hold due to salary cuts or furloughs, or an entire US state holding back on a major bridge project due to budget cuts, 2020 is proving to be a year for fixing what we already have, rather than rebuilding from scratch.

For construction and maintenance retailers, this isn’t all bad news. Rather than remodeling or replacing, consumers are instead repairing the products and appliances they already have, which has caused an increased demand for brand name replacement parts. The anticipated global energy demand decreases are actually benefiting homeowner repair retail companies. One home retail CEO told CNBC that due to a large DIY customer base upgrading home appliances and revamping home projects, his company experienced a surprising first quarter boost.

While world economies begin to plan out what post-Covid global markets and human infrastructure are going to look like, this is a good time to be used for contemplation, re-construction, and examine what needs to be changed.

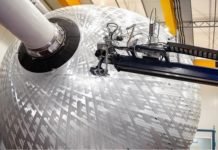

Green energy continues to rise unabated

Sustainable energy projects, including wind, solar, and hydroelectric power continued in construction up until and through the pandemic thus far, with their resources now coming to bear in an energy market that this year has been increasingly less reliant on home and office electricity, oil, and coal. While demand remains, overall renewable growth is decreasing this year, simply due to human activity stagnation during the pandemic.

While the Economist predicted in April that many energy suppliers will be forced to shutter their business in the disastrous economic wake left by the global pandemic, now, more than ever, is a time when national economies and multinational industries are increasingly moving investments in the direction of renewable energies. This includes nuclear power, which, although it is experiencing a project 3% decline in demand this year, remains a significant source of renewable energy supply in much of the developed world, particularly in such powerhouses as Japan, France, and the United States.